Fund inception is 12/31/2013. The maximum sales charge (load) for Class A is 5.75%. The performance data quoted here represents past performance. For performance data current to the most recent month end, please call toll-free 855.501.4758. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Fund’s total annual operating expenses are 1.79%, 2.54%, 1.54%, and 1.79% for Class A, C, I and N respectively. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses, including other share classes.

Definitions and Important Risk Information

Barclays Global Agg Bond Index: Measures global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Bloomberg U.S. Aggregate Index (US Agg): A broad benchmark index that tracks the performance of U.S. dollar-denominated, investment-grade fixed-income securities, including government, corporate, mortgage-backed, and asset-backed bonds.

Correlation: A statistical measure of the degree to which two securities move in relation to each other. Correlations are computed as the correlation coefficient, which has a value that must fall between -1.0 and +1.0.

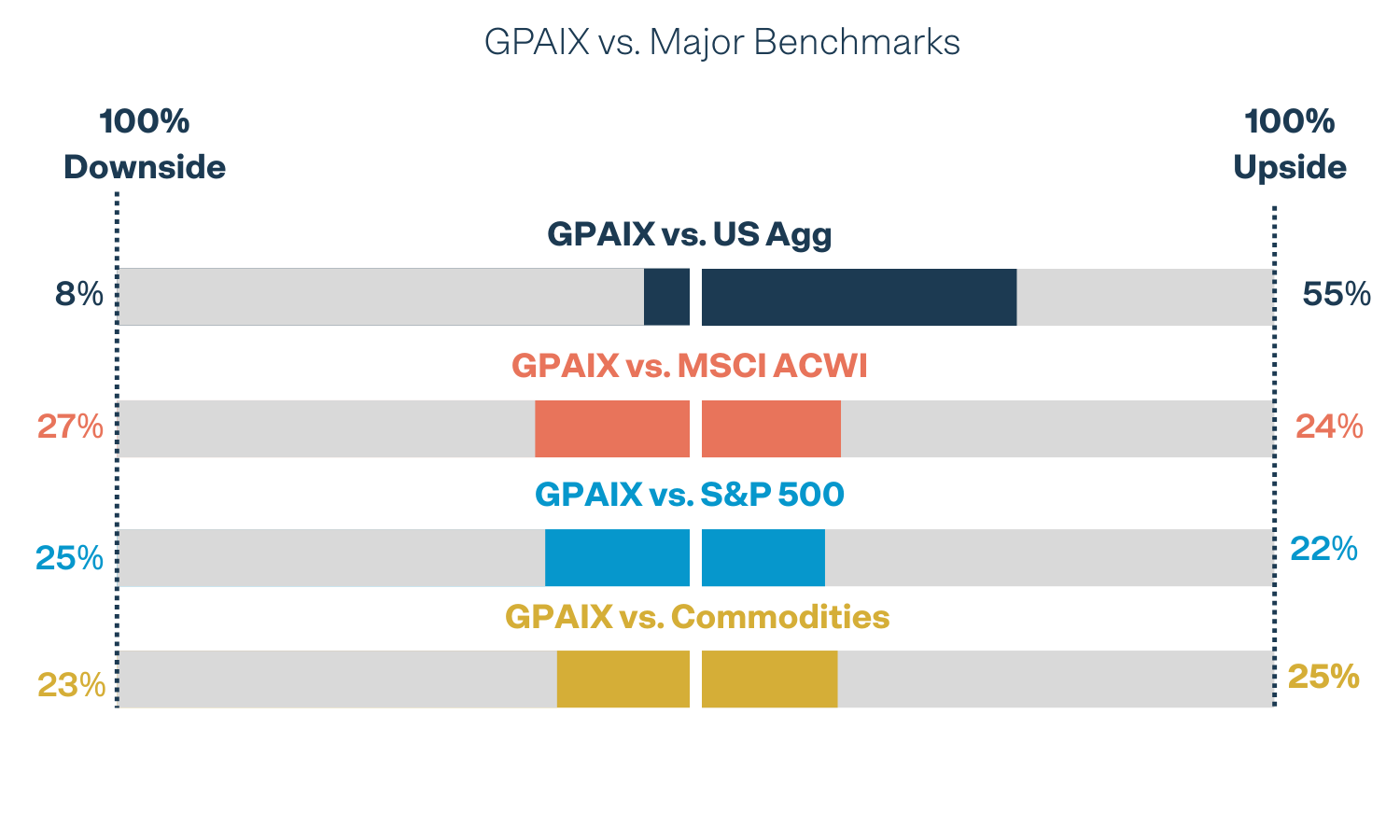

Down Capture: A statistical measure of an investment manager's overall performance in down-markets. The ratio is calculated by dividing the manager's returns by the returns of the index during the down-market and multiplying that factor by 100.

Long-only Broad Basket Commodities: Long only strategy that tracks the price of goods including but not limited to grains, minerals, metals, livestock, cotton, oils, sugar, coffee and cocoa.

Long Contract: A contract to accept delivery (i.e. to buy) a specified amount of a commodity at a future date at a specified price.

Momentum: A quantitative investment approach that attempts to identify the early emergence of a price trend.

MSCI All World Index: Represents performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets.

Risk Premia: An investment approach that captures market returns associated with specific risk factors in a diversified, efficient, and risk-conscious manner.

Short Contract: A contract to make delivery (i.e. to sell) a specified amount of a commodity at a future date at a specified price.

Standard & Poor's 500 Total Return Index: A weighted index consisting of the 500 stocks in the S&P 500 Index, which are chosen by Standard & Poor's based on industry representation, liquidity, and stability. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

Standard Deviation (Volatility): A statistical measure of the dispersion of a dataset relative to its mean and is calculated as the square root of the variance.

Up Capture: A statistical measure of an investment manager's overall performance in up-markets. The ratio is calculated by dividing the manager's returns by the returns of the index during the up-market and multiplying that factor by 100.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Grant Park Funds. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 855.501.4758. The Prospectus should be read carefully before investing.

The Grant Park Mutual Funds are distributed by Northern Lights Distributors, LLC

member FINRA / SIPC. Dearborn Capital Management, LLC is not affiliated with Northern Lights Distributors, LLC.

Diversification does not ensure a profit or protect against a loss.

Mutual Funds involve risk including the possible loss of principal.

There is no assurance that a fund will achieve its investment objectives. Investing in the commodities markets may subject the Fund to greater volatility than investments in traditional securities. There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund. Derivative instruments involve risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. There could be an imperfect correlation between the change in market value of the instruments held by the Fund and the price of the forward or futures contract or the fund may have to sell at a disadvantageous time. The success of hedging strategies depends on the advisor's or sub-advisor's ability to correctly assess the correlation between the instrument and portfolio being hedged and may result in loss.

In general, the price of a fixed income and U.S. Government security falls when interest rates rise. Currency trading risks include market risk, credit risk and country risk. Investments in foreign securities could subject the Fund to greater risks including, currency fluctuation, economic conditions, and different governmental and accounting standards. Sovereign Debt investments are subject to the risk that a governmental entity may delay or refuse to pay interest or repay principal. Using derivatives to increase the Fund's combined long and short exposure creates leverage, which can magnify the Fund's potential for gain or loss. The Commodity Futures Trading Commission (CFTC) has proposed changes to Rule 4.5 under the Commodity Exchange Act which, if adopted, could require the Fund and the Subsidiary to register with the CFTC. Short positions may be considered speculative transactions and involve special risks, including greater reliance on the advisor's ability to accurately anticipate the future value of a security or instrument.

Underlying Funds are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in an Underlying Fund. By investing in commodities indirectly through the Subsidiary, the Fund will obtain exposure to the commodities markets within the federal tax requirements that apply to the Fund, which may be taxed at less favorable rates than capital gains. The Subsidiary will not be registered under the Investment Company Act of 1940 ("1940 Act") and, unless otherwise noted in the Prospectus, will not be subject to all of the investor protections of the 1940 Act.

NLD Code: 20260204-5167759